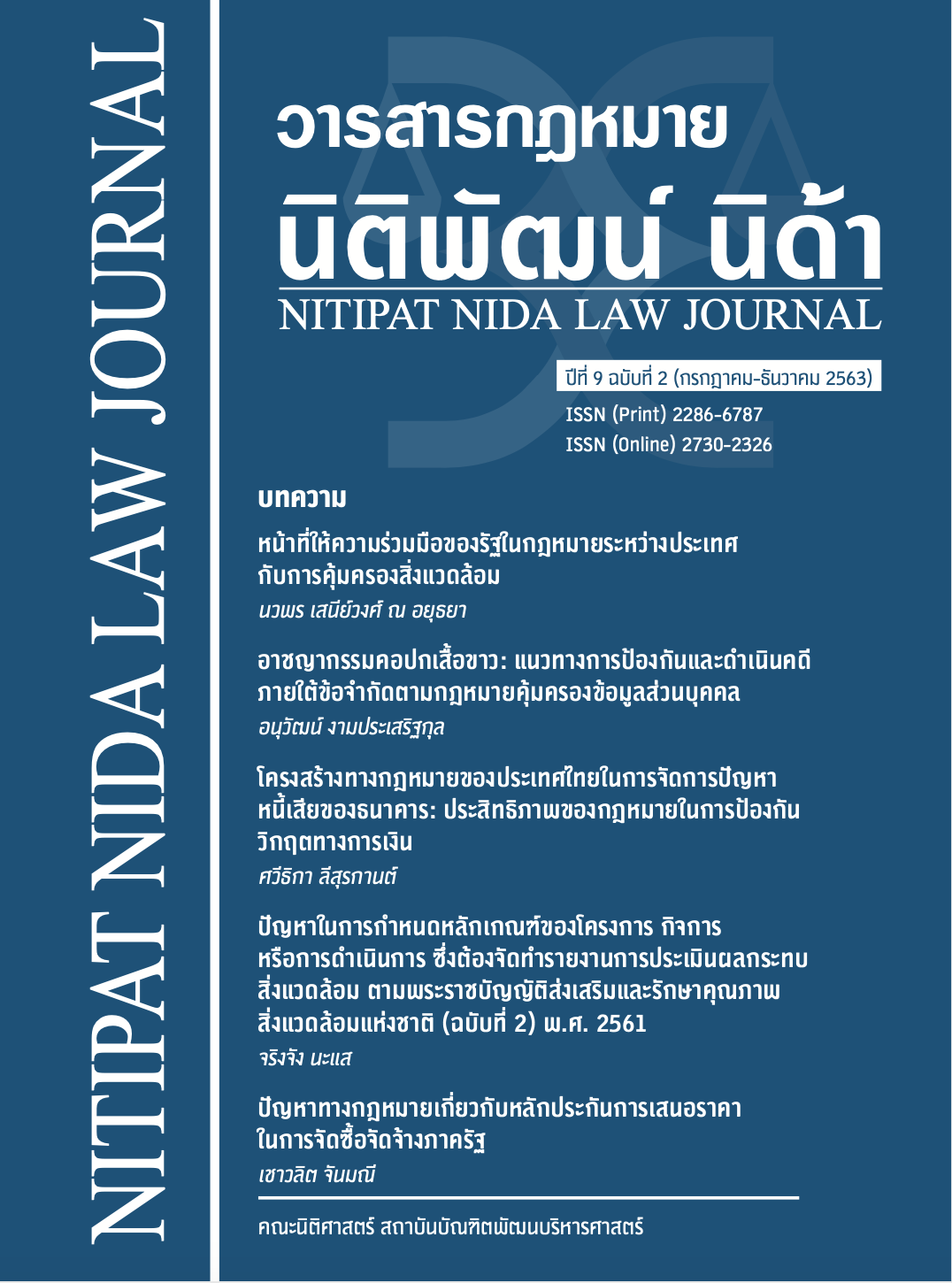

Thai Legal Framework for Addressing Non-Performing Loans: the Effectiveness of Thai Laws in Preventing Financial Crisis

Abstract

The non-performing loans ratio of banks is not only an indicator of their assets, which is essential for investors to make their business decision but also it shows the stability of the banking system in each country. When the non-performing loans are high, it gives effect to banks’ profits and could lead to bank insolvency, which has an impact on financial stability and economic status. Moreover, when financial institutions are bankrupt or fail, it can lead to the financial crisis, which can be contagious and eventually cause the global financial crisis. Therefore, it is vital to have a systematic NPL management measure.

However, there is no legal framework on NPL management, such as the sale of NPL or the execution. This research will examine the current solutions which relevant to NPLs specific to bank regulations on capital requirements and loan loss provision (LLP) under the Financial Institution Business Act through the lens of the efficiency in NPL management.