IMPROVING STOCK INVESTMENT DECISION WITH ARTIFICIAL NEURAL NETWORK

Main Article Content

บทคัดย่อ

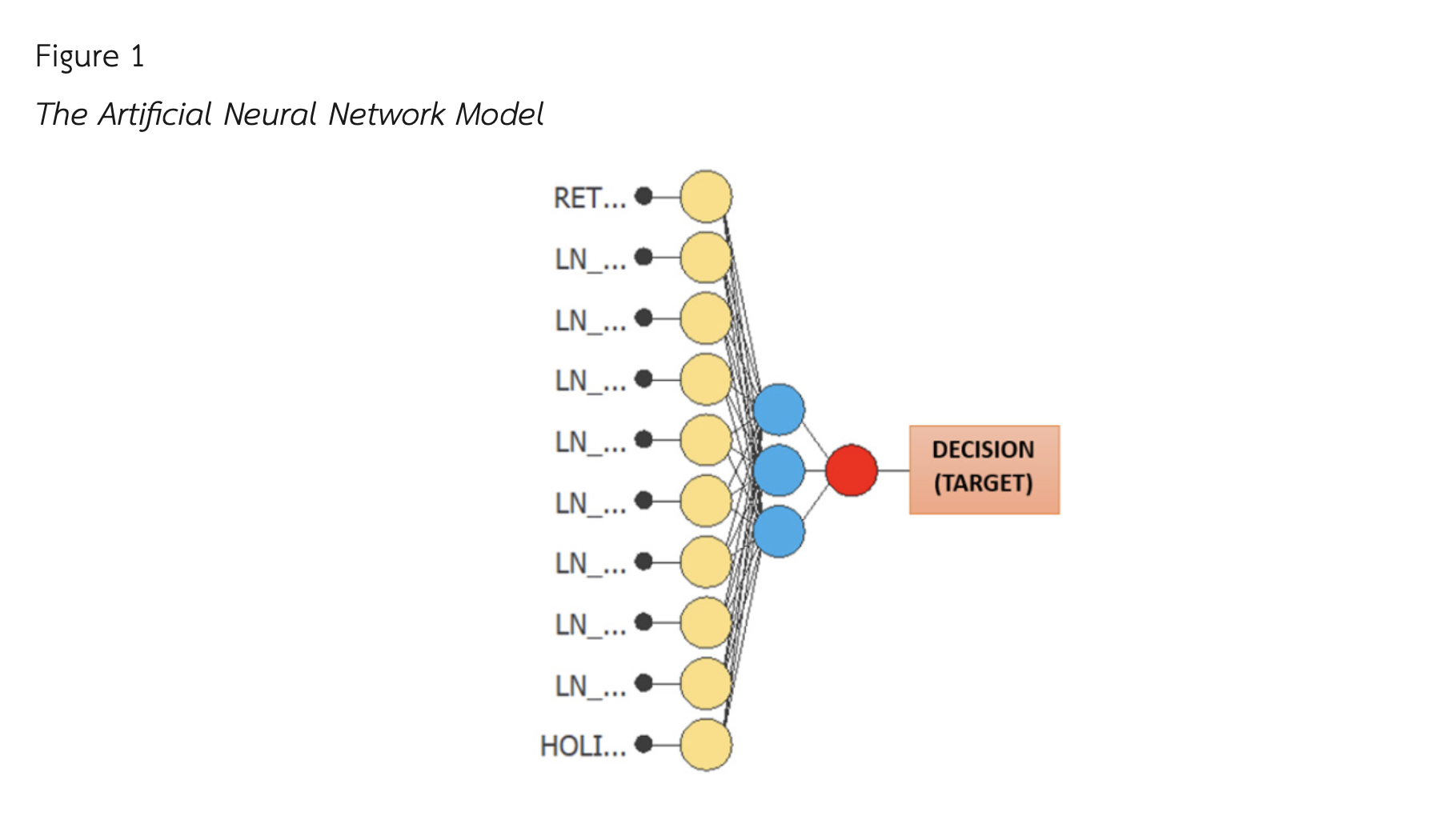

Artificial neural network (ANN) is used for providing investment decisions to investors but are not yet widespread in the Thai stock market because of doubts about the effectiveness of such techniques and the market efficiency level, which makes trading data unable to be used to predict the future direction of stock prices. Thus, this study aims to explore the effectiveness of using artificial neural networks to improve investment decisions and to prove the efficiency of the Stock Exchange of Thailand by testing the accuracy of investment decision recommendations from such techniques. The independent variables of this research are from data from the previous day, which are typically used in technical analysis, including price, trading value, returns, the existence of holiday after trading, and returns of the Dow Jones Index, which represents foreign investment. The reason for using these data is that they reflect the information on demand and supply in stock trading, and the domestic stock exchange and foreign stock exchanges publicly disclose them. The results of the study support the feasibility of using ANN to provide decision advice to investors. The recommendations were correct up to 70% and showed that the Stock Exchange of Thailand was not able to meet the assumption of low pricing efficiency.

Article Details

เอกสารอ้างอิง

Altarawneh, G. A., Hassanat, A. B., Tarawneh, A. S., Abadleh, A., Alrashidi, M., & Alghamdi, M. (2022). Stock price forecasting for jordan insurance companies amid the covid-19 pandemic utilizing off-the-shelf technical analysis methods. Economies, 10(2), 43.

Ayala, J., García-Torres, M., Noguera, J. L. V., Gómez-Vela, F., & Divina, F. (2021). Technical analysis strategy optimization using a machine learning approach in stock market indices. Knowledge-Based Systems, 22(5), 107-119.

Blume, L., Easley, D., & O'hara, M. (1994). Market statistics and technical analysis: The role of volume. The journal of finance, 49(1), 153-181.

Brock, W., Lakonishok, J., & LeBaron, B. (1992). Simple technical trading rules and the stochastic properties

of stock returns. The Journal of finance, 47(5), 1731-1764.

Devadoss, A. V., & Ligori, T. A. A. (2013). Stock prediction using artificial neural networks. International Journal of Data Mining Techniques and Applications, 2(1), 283-291.

Dinh, T. A., & Kwon, Y. K. (2018, August). An empirical study on importance of modeling parameters and trading volume-based features in daily stock trading using neural networks. In Informatics, 5,(3), 36.

Erdaş, M. L., & Yağcilar, G. G. (2020). Does Exchange Rate Follow The Weak Form Market Efficiency In Next

Countries? Evidence From Comprehensive Unit Root Tests. Finans Ekonomi ve Sosyal Araştırmalar Dergisi, 5(3), 451-471.

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The journal of Finance, 25(2), 383-417.

Hassani, H., & Silva, E. S. (2015). Forecasting with big data: A review. Annals of Data Science, 2(1), 5-19.

Hsu, P. H., & Kuan, C. M. (2005). Reexamining the profitability of technical analysis with data snooping checks. Journal of Financial Econometrics, 3(4), 606-628.

Khan, Z. H., Alin, T. S., & Hussain, M. A. (2011). Price prediction of share market using artificial neural

network (ANN). International Journal of Computer Applications, 22(2), 42-47.

Konak, F., & Şeker, Y. (2014). The efficiency of developed markets: Empirical evidence from FTSE 100.

Journal of Advanced Management Science, 2(1), 22-34.

Kong, Y., Owusu-Akomeah, M., Antwi, H. A., Hu, X., & Acheampong, P. (2019). Evaluation of the robusticity of mutual fund performance in ghana using enhanced resilient backpropagation neural network (ERBPNN) and fast adaptive neural network classifier (FANNC). Financial innovation, 5(1), 1-12.

Lam, M. (2004). Neural network techniques for financial performance prediction: integrating fundamental and technical analysis. Decision support systems, 37(4), 567-581.

Ling, P. S., & Ruzita, A. R. (2017). Market efficiency based on unconventional technical trading strategies in Malaysian stock market. International Journal of Economics and Financial Issues, 7(3), 88-96.

Picasso, A., Merello, S., Ma, Y., Oneto, L., & Cambria, E. (2019). Technical analysis and sentiment

embeddings for market trend prediction. Expert Systems with Applications, 13(5), 60-70.

Rahman, S., & Hossain, M. F. (2006). Weak-form efficiency: Testimony of Dhaka stock exchange. Journal of business research, 8(2), 1-12.

Ratner, M., & Leal, R. P. (1999). Tests of technical trading strategies in the emerging equity markets of Latin America and Asia. Journal of Banking & Finance, 23(12), 1887-1905.

Sezer, O. B., Ozbayoglu, A. M., & Dogdu, E. (2017, April). An artificial neural network-based stock trading system using technical analysis and big data framework. In proceedings of the southeast conference (pp. 223-226).

Shil, N. C., & Kotha, A. T. (2021). Exploring the Impact of Policy Reforms on Market Efficiency: Evidence

from Dhaka Stock Exchange. IUP Journal of Applied Finance, 27(2), 5-27.

Sullivan, R., Timmermann, A., & White, H. (1999). Data‐snooping, technical trading rule performance, and

the bootstrap. The journal of Finance, 54(5), 1647-1691.

Sun, X. Q., Shen, H. W., Cheng, X. Q., & Zhang, Y. (2016). Market confidence predicts stock price: Beyond supply and demand. PloS one, 11(7),15-38.

Thenmozhi, M. (2006). Forecasting stock index returns using neural networks. Delhi Business Review, 7(2),59-69.

Tsai, C. F., & Wang, S. P. (2009, March). Stock price forecasting by hybrid machine learning techniques. In Proceedings of the international multiconference of engineers and computer scientists, 1(2), 755.

Vanstone, B., & Finnie, G. (2010). Enhancing stock market trading performance with ANNs. Expert Systems with Applications, 37(9), 6602-6610.

Vijh, M., Chandola, D., Tikkiwal, V. A., & Kumar, A. (2020). Stock closing price prediction using machine learning techniques. Procedia Computer Science, 16(7), 599-606.

Vui, C. S., Soon, G. K., On, C. K., Alfred, R., & Anthony, P. (2013, November). A review of stock market prediction with Artificial neural network (ANN). In 2013 IEEE international conference on control system, computing and engineering (pp. 477-482). IEEE.

Wirawan, G. H., & Sumirat, E. (2021). Performance analysis of investment portfolio strategy using Warren Buffett, Benjamin Graham, and Peter Lynch Method in Indonesia Stock Exchange. European Journal of Business and Management Research, 6(4), 394-401.

Yousaf, T., Farooq, S., & Mehta, A. M. (2021). An investigation of time varying market efficiency: evidence

from STOXX Europe Christian index. International Journal of Ethics and Systems, 37(4), 631-643.

Yu, H., Nartea, G. V., Gan, C., & Yao, L. J. (2013). Predictive ability and profitability of simple technical trading rules: Recent evidence from Southeast Asian stock markets. International Review of Economics & Finance, 25(3), 356-371.