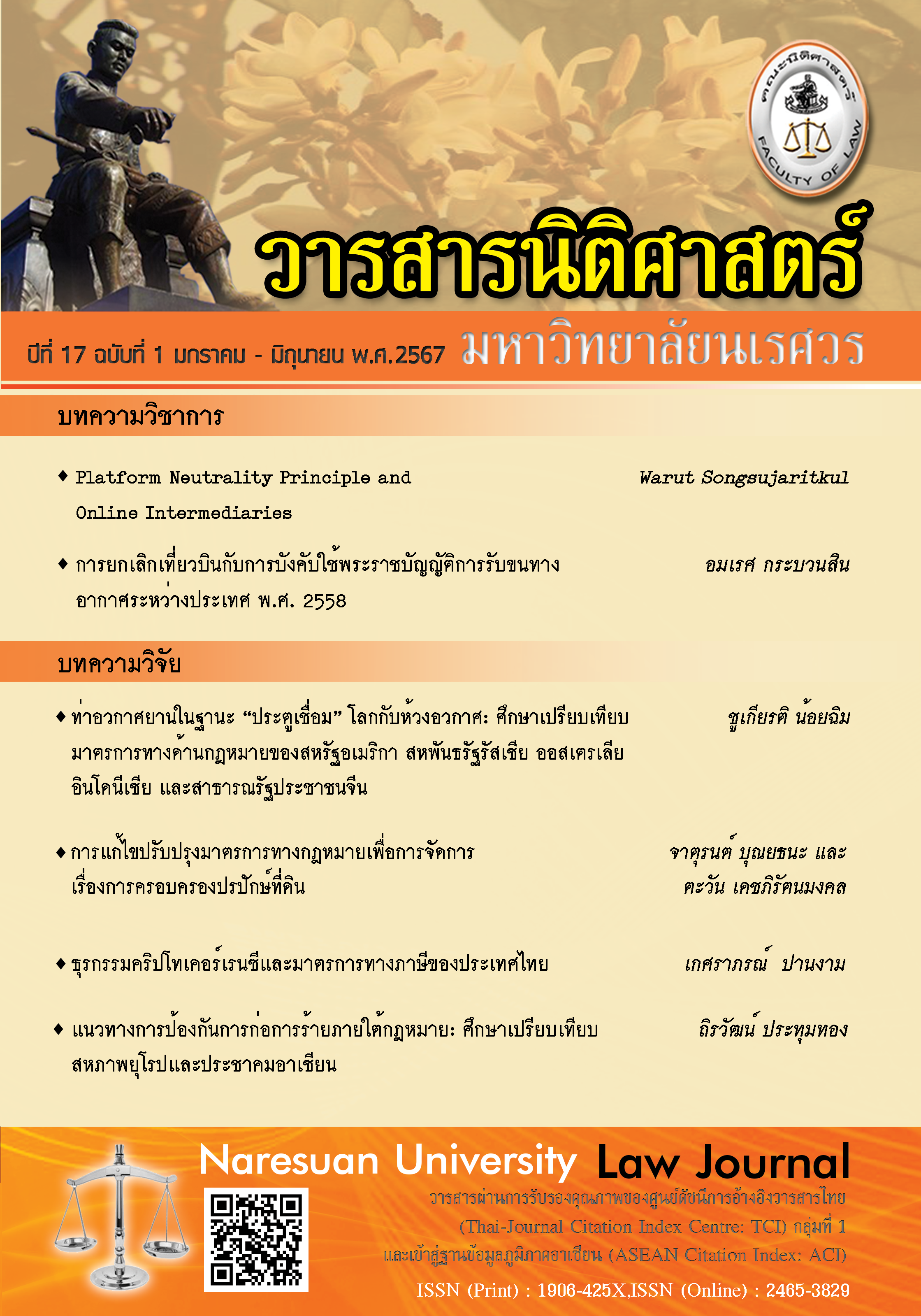

Cryptocurrency Transactions and Thai Tax Measures

Main Article Content

Abstract

Cryptocurrencies have been used more extensively in transactions. Cryptocurrency transactions may result in generating income to users. Thailand has therefore enacted the Emergency Decree amending the Revenue Code (No. 19) B.E. 2018 to specifically collect personal income tax from transferring cryptocurrencies. The main objective of this research article is to analyse measures to collect personal income tax from cryptocurrency transactions in Thailand, the United States and Australia. The results of the analysis found that the collection of personal income tax from cryptocurrency transactions in Thailand has remained incomprehensive and unclear in many aspects. The research article therefore proposes guidelines for the improvement which are the provision of the comprehensive and clear explanation of personal income tax payment for taxpayers, amendments to the tax law regarding cryptocurrency transactions and measures to monitor and investigate cryptocurrency transactions. The proposed guidelines could contribute to the more efficient personal income tax collection from cryptocurrency transactions in Thailand.

Article Details

References

Australian Taxation Office (ATO). “Crypto as a Personal Use Asset: Using Crypto to Buy Items for Personal Use or Consumption.” Last modified June 30, 2023. Accessed June 30, 2023. https://www.ato.gov.au/individuals/Investments-and-assets/crypto-asset-investments/crypto-as-a-personal-use-asset/.

Australian Taxation Office (ATO). “Crypto as a Personal Use Asset: What is a Personal Use Asset?.” Last modified June 30, 2023. Accessed June 30, 2023, https://www.ato.gov.au/individuals/Investments-and-assets/crypto-asset-investments/crypto-as-a-personal-use-asset/.

Australian Taxation Office (ATO). “Crypto Assets 2014–15 to 2022–23 Data-Matching Program Protocol.” Last Modified June 29, 2022. Accessed June 30, 2023. https://www.ato.gov.au/General/Gen/Crypto-assets-2014-15-to-2022-23-data-matching-program-protocol/.

Australian Taxation Office (ATO). “Crypto Chain Splits: Chain Splits.” Last modified June 30, 2023. Accessed June 30, 2023. https://www.ato.gov.au/individuals/Investments-and-assets/crypto-asset-investments/crypto-chain-splits/.

Bank of Thailand. “Policy Guidelines for Regulating Stablecoins.” Accessed October 10, 2023. https://www.bot.or.th/th/news-and-media/news/news-20210319-2.html. [In Thai]

Bank of Thailand. “Using of Digital Assets as Means of Payment.” Accessed October 10, 2023. https://www.bot.or.th/th/news-and-media/news/news-20210708-1.html. [In Thai]

Banyat Sucheewa. Commentary on the Law of Property. 12th ed. Bangkok: The Thai Bar Under the Royal Patronage, 2552. [In Thai]

Bitcoin Thailand. “What is Proof of Work?.” Accessed September 15, 2023. https://bitcointhailand.org/what-is-proof-of-work/. [In Thai]

Bitkub Academy. “Hard Fork vs. Soft Fork.” Accessed October 15, 2023. https://www.bitkubacademy.com/th/blog/hard-fork-vs-soft-fork. [In Thai]

Bitkub Exchange. “Proof of Work vs. Proof of Stake: Compare to See the Clear Pictures.” Accessed October 15, 2023. https://www.bitkub.com/th/blog/proof-of-work-proof-of-stake-2a5ed294dca3. [In Thai]

Coinbase. “What is Fork.” Accessed October 15, 2023. https://www.coinbase.com/th/learn/crypto-basics/what-is-a-fork. [In Thai]

Conlon, Stevie D., et al. “IRS Guidance: Newly Enacted Tax Rules Subject Digital Assets, Including Cryptocurrencies, to Form 1099-B Reporting and to Cash Reporting Rules on Form 8300.” Journal of Taxation of Financial Products 18, no. 4 (2022): 5-16.

Conlon, Stevie D., et al. “IRS Releases New Cryptocurrency Tax Guidance.” Journal of Tax Practice & Procedure 21, no. 5 (2019): 19-21.

Cotler, Brett. “Cryptocurrency Tax Update: If There’s a Hard Fork in the Road, Take It (or Not).” Journal of Taxation of Investments 37, no. 2 (2020): 43-48.

Erdmann, Charlotte A. “The Taxation of Cryptocurrencies.” The Florida Bar Journal, 94, no. 4 (2021): 58-64.

Finnomena. “What is Yield Farming? Mining to Make Profit on Defi as A Farmer.” Accessed October 15, 2023. https://www.finnomena.com/bitcoinaddict/what-is-yield-farming/. [In Thai]

Gama, Doris Stacey. “Creating Something out of Nothing: Taxation of Cryptocurrency Hard Forks.” Journal of Science and Technology 31, no. 3 (2021): 258-297.

Guglyuvatyy, Evgeny. “Regulating a New Phenomenon: Examining the Legal Nature and Taxation of Cryptocurrencies in Australia and Singapore.” Australian Tax Forum 35 (2020): 351-367.

Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash System.” Accessed March 15, 2023. https://nakamotoinstitute.org/bitcoin/.

Organisation for Economic Co-operation and Development. Taxing Virtual Currencies: An Overview of Tax Treatments and Emerging Tax Policy Issues. Paris: OECD, 2020. Accessed March 15, 2022. https://www.oecd.org/tax/tax-policy/taxing-virtual-currencies-an-overview-of-tax-treatments-and-emerging-tax-policy-issues.htm.

Peerapat Hankhongkaew, and Akaradej Diaopanich. Digital Asset Investment 101 from Bitcoin to New Era Investment in Digital Assets. Bangkok: Stock2morrow, 2021. [In Thai]

Pornchai Chunhachinda. “Lessons from the First Decade of Cryptocurrencies.” Electronic Journal of Open and Distance Innovative Learning 8, no. 1 (2018): 1-28 [In Thai]

Powel, Karen, and Monica Hope. “Shifting Digital Currency Definitions: Current Considerations in Australian and Us Tax Law.” eJournal of Tax Research 16, no. 3 (2019): 594-619.

Revenue Department. Personal Income Tax Payment Cryptocurrency Digital Token Handbook. Bangkok: Revenue Department, 2022. [In Thai]

Surapha Srimuang. “Problems concering Payment by Cryptocurrencies (Radio Article: The Secretariat of The House of Representatives).” Accessed September 20, 2023.

https://www.parliament.go.th/ewtadmin/ewt/elaw_parcy/ewt_dl_link.php?nid=3069. [In Thai]

Techsauce. “Public Key and Private Key: 2 Important Keys of Crypto Wallet You Need to Know.” Accessed October 10, 2023. https://techsauce.co/tech-and-biz/private-key-vs-public-key. [In Thai]

The Internal Revenue Service (IRS). “Frequently Asked Questions on Virtual Currency Transactions.” Last modified May 2, 2023. Accessed May 7, 2023. https://www.irs.gov/individuals/international-taxpayers/frequently-asked-questions-on-virtual-currency-transactions.

The Office of the Securities and Exchange Commission. “Digital Asset Market Report, 29 September 2023.” Accessed October 26, 2023. https://www.sec.or.th/TH/PublishingImages/Pages/WeeklyReport/DAWeeklyReport20230929.jpg. [In Thai]

Wood, Robert W., and Alex Brown. “Considering Cryptocurrency Tax Myths.” Tax Notes Federal 173 (2021): 355-359.