การวิเคราะห์อัตราผลตอบแทนสำหรับการออมเพื่อเกษียณโดยใช้ค่าปัจจุบัน

Main Article Content

บทคัดย่อ

บทความนี้มีจุดมุ่งหมายเพื่อแสดงให้เห็นถึงการประยุกต์คณิตศาสตร์มาใช้ประโยชน์ต่อการตัดสินใจในการเลือกลงทุนออมกับสถาบันการเงินที่ให้ผลตอบแทนที่ดีสำหรับโครงการออมเพื่อเกษียณ ความรู้ทางคณิตศาสตร์เกี่ยวกับดอกเบี้ยและค่าปัจจุบันสามารถนำมาวิเคราะห์เปรียบเทียบผลตอบของแต่ละโครงการออมเพื่อเกษียณของสถาบันการเงิน เพื่อเป็นแนวทางช่วยในการตัดสินใจเลือกการออมที่ดี มีการสาธิตวิธีการวิเคราะห์จริงกับโครงการออมเพื่อเกษียณของสถาบันการเงินเพื่อเปรียบเทียบผลตอบแทนที่ดีที่สุดภายใต้เงื่อนไขเดียวกัน ผลลัพธ์ที่ได้จะทำให้เห็นว่าการนำคณิตศาสตร์เข้ามาช่วยจะเป็นอีกหนึ่งทางที่จะช่วยให้การวางแผนเกี่ยวกับการเงินมีประสิทธิภาพมากขึ้น

Article Details

วารสารวิทยาศาสตร์และวิทยาศาสตร์ศึกษา (JSSE) เป็นผู้ถือลิสิทธิ์บทความทุกบทความที่เผยแพร่ใน JSSE นี้ ทั้งนี้ ผู้เขียนจะต้องส่งแบบโอนลิขสิทธิ์บทความฉบับที่มีรายมือชื่อของผู้เขียนหลักหรือผู้ที่ได้รับมอบอำนาจแทนผู้เขียนทุกนให้กับ JSSE ก่อนที่บทความจะมีการเผยแพร่ผ่านเว็บไซต์ของวารสาร

แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form)

ทางวารสาร JSSE ได้กำหนดให้มีการกรอกแบบโอนลิขสิทธิ์บทความให้ครบถ้วนและส่งมายังกองบรรณาธิการในข้อมูลเสริม (supplementary data) พร้อมกับนิพนธ์ต้นฉบับ (manuscript) ที่ส่งมาขอรับการตีพิมพ์ ทั้งนี้ ผู้เขียนหลัก (corresponding authors) หรือผู้รับมอบอำนาจ (ในฐานะตัวแทนของผู้เขียนทุกคน) สามารถดำเนินการโอนลิขสิทธิ์บทความแทนผู้เขียนทั้งหมดได้ ซึ่งสามารถอัพโหลดไฟล์บทความต้นฉบับ (Manuscript) และไฟล์แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form) ในเมนู “Upload Submission” ดังนี้

1. อัพโหลดไฟล์บทความต้นฉบับ (Manuscript) ในเมนูย่อย Article Component > Article Text

2. อัพโหลดไฟล์แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form) ในเมนูย่อย Article Component > Other

ดาวน์โหลด ไฟล์แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form)

เอกสารอ้างอิง

Coopersmith, L. W., & Sumutka, A. R. (2011). Tax-efficient retirement withdrawal planning using a linear programming model. Journal of Financial Planning, 24(9), 50-59.

Deeley, C. (2007). Mathematical and modelling aspects of retirement planning. JASSA, 1, 27-35.

Dong, F., Halen, N., Moore, K., & Zeng, Q. (2019). Efficient retirement portfolios: using life insurance to meet income and bequest goals in retirement. Risks, 7(9), 1-11.

Foziah, N. H. M., Ghazali, P. L., Mamat, M., Salleh, F., & Mohamed, S. B. (2017). Mathematical analysis of retirement income benefit based on annuitization approach. International Journal of Academic Research in Business and Social Sciences, 7(7), 865-871.

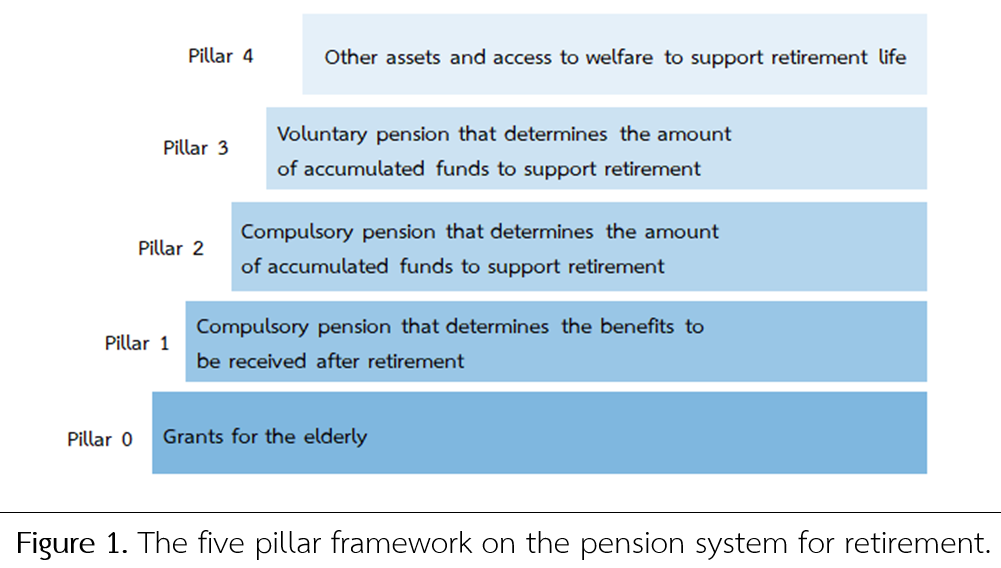

Holzmann, R., Hinz, R. P., & Dorfman, M. (2008). Pension systems and reform conceptual framework. World Bank Discussion Paper, 824.

Lusardi, A. (2009). Planning for retirement: The importance of financial literacy. Public Policy and Aging Report, 19(3), 7-13.

Rappaport, A.M. & Ward, G. (2017). Filling in the gaps: helping employee plan better for retirement. Benefits Magazine, 54(12), 40-45.

Schmidt, C. (2016). A journey through time: From the present value to the future value and back or: Retirement planning: A comprehensible application of the time value of money concept. American Journal of Business Education, 9(3), 1-7.