ตัวแบบส่วนแบ่งการตลาดของบริษัทบริการส่งอาหาร

Main Article Content

บทคัดย่อ

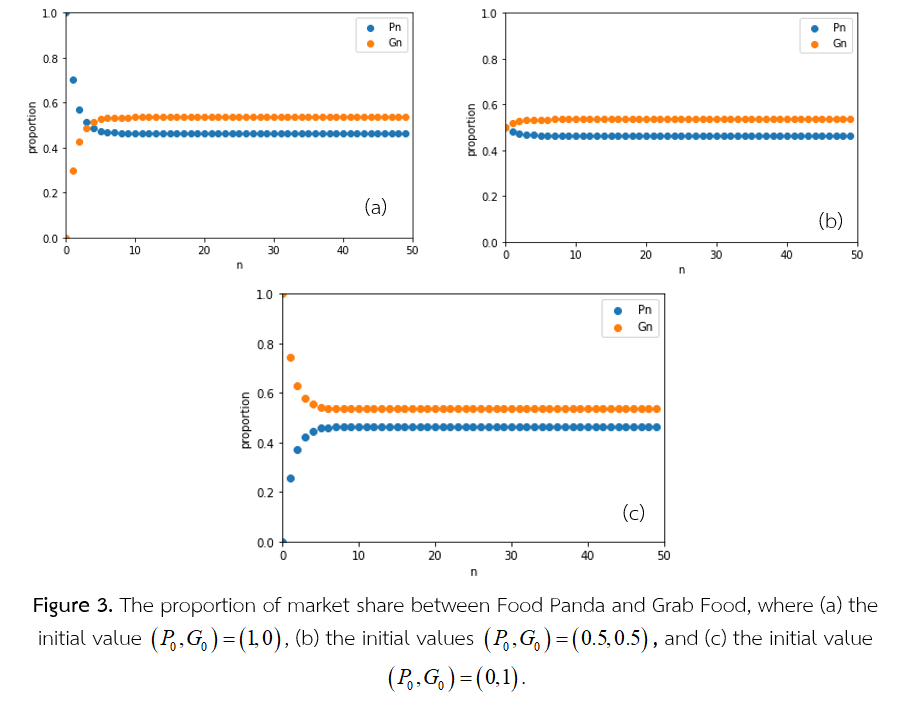

การวิจัยครั้งนี้มีวัตถุประสงค์เพื่อนำเสนอการสร้างตัวแบบเชิงคณิตศาสตร์ส่วนแบ่งการตลาดของบริษัทบริการส่งอาหารด้วยระบบสมการผลต่าง โดยเริ่มต้นจากการศึกษารูปแบบการวิเคราะห์ในรูปลูกโซ่มาร์คอฟแล้วแปลงเป็นระบบสมการผลต่าง เพื่อกำหนดค่าพารามิเตอร์ของตัวแบบได้มีการสุ่มตัวอย่างนักศึกษาจำนวน 121 คน เพื่อตอบแบบสอบถามเกี่ยวกับการกลับมาใช้บริการและความพึงพอใจการบริการของแต่ละบริษัท ข้อมูลทั้งสองด้านนี้จะนำมาพิจารณาคำนวณค่าพารามิเตอร์ของตัวแบบ มีการใช้โปรแกรมไพธอนเข้ามาช่วยในการคำนวณหาผลเฉลยของตัวแบบเพื่อวิเคราะห์พฤติกรรมส่วนแบ่งการตลาดระยะยาวของบริษัทบริการส่งอาหาร ซึ่งจากการกำหนดเงื่อนไขของส่วนแบ่งการตลาดที่แตกต่างกัน 3 เงื่อนไขพบว่า เมื่อผ่านไประยะยาวค่าส่วนแบ่งการตลาดจะลู่เข้าสู่สัดส่วนคงที่ค่าเดียวกันทั้ง 3 กรณี ซึ่งผลที่ได้นี้จะเป็นข้อมูลสารสนเทศเชิงคณิตศาสตร์ที่มีประโยชน์ให้กับบริษัทบริการส่งอาหารได้เตรียมพร้อมบริหารจัดการทั้งในแง่การตลาดและการบริการ

Article Details

วารสารวิทยาศาสตร์และวิทยาศาสตร์ศึกษา (JSSE) เป็นผู้ถือลิสิทธิ์บทความทุกบทความที่เผยแพร่ใน JSSE นี้ ทั้งนี้ ผู้เขียนจะต้องส่งแบบโอนลิขสิทธิ์บทความฉบับที่มีรายมือชื่อของผู้เขียนหลักหรือผู้ที่ได้รับมอบอำนาจแทนผู้เขียนทุกนให้กับ JSSE ก่อนที่บทความจะมีการเผยแพร่ผ่านเว็บไซต์ของวารสาร

แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form)

ทางวารสาร JSSE ได้กำหนดให้มีการกรอกแบบโอนลิขสิทธิ์บทความให้ครบถ้วนและส่งมายังกองบรรณาธิการในข้อมูลเสริม (supplementary data) พร้อมกับนิพนธ์ต้นฉบับ (manuscript) ที่ส่งมาขอรับการตีพิมพ์ ทั้งนี้ ผู้เขียนหลัก (corresponding authors) หรือผู้รับมอบอำนาจ (ในฐานะตัวแทนของผู้เขียนทุกคน) สามารถดำเนินการโอนลิขสิทธิ์บทความแทนผู้เขียนทั้งหมดได้ ซึ่งสามารถอัพโหลดไฟล์บทความต้นฉบับ (Manuscript) และไฟล์แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form) ในเมนู “Upload Submission” ดังนี้

1. อัพโหลดไฟล์บทความต้นฉบับ (Manuscript) ในเมนูย่อย Article Component > Article Text

2. อัพโหลดไฟล์แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form) ในเมนูย่อย Article Component > Other

ดาวน์โหลด ไฟล์แบบโอนลิขสิทธิ์บทความ (Copyright Transfer Form)

เอกสารอ้างอิง

Albright, B. and Fox, W. P. (2019). Mathematical modeling with excel. CRC Press.

Andrieu, C., Doucet, A. and Holenstein, R. (2010). Particle markov chain monte carlo methods. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 72(3), 269-342.

Bidabad, B. and Bidabad, B. (2019). Complex probability and Markov stochastic process. Indian Journal of Finance and Banking, 3(1), 13-22.

Fox, W. P. (2011). Mathematical modeling with Maple. Nelson Education.

Giordano, F. R., Fox, W. P. and Horton, S. B. (2013). A first course in mathematical modeling. Nelson Education.

Kassa, A. M., Abrham, E. and Seid, T. (2017). Application of markov chain analysis model for predicting monthly market share of restaurants. International Journal of Recent Engineering Research and Development, 2(30), 48-55.

Myers, D., Wallin, L. and Wikström, P. (2017). An introduction to Markov chains and their applications within finance. Retrieved 21 March 2019, from Department of Mathematical Sciences, Chalmers University of Technology: http://www.math.chalmers.se/Stat/Grundutb/CTH/ mve220/1617/redingprojects16-17/IntroMarkovChainsandApplications.pdf.

Seebut, S. (2020). Mathematical modeling of stock market states using the system of a difference equation. Journal of Science and Science Education, 3(2), 200-208.

Svoboda, M. and Lukas, L. (2012). Application of Markov chain analysis to trend prediction of stock indices. In Proceedings of 30th international conference mathematical methods in economics (pp. 848-853). Karviná: Silesian University, School of Business Administration.

Vasanthi, S., Subha, M. V. and Nambi, S. T. (2011). An empirical study on stock index trend prediction using markov chain analysis. Journal of Banking Financial Services and Insurance Research, 1(1), 72-91.

Yu, K. and Sato, T. (2019). Modeling and analysis of error process in 5G wireless communication using two-state Markov chain. IEEE Access, 7, 26391-26401.

Zhang, D. and Zhang, X. (2009). Study on forecasting the stock market trend based on stochastic analysis method. International Journal of Business and Management, 4(6), 163-170.