The Impact of Financial Warning Signal on Profitability of Agricultural Cooperatives in Thailand

DOI:

https://doi.org/10.14456/nrru-rdi.2024.7Keywords:

Financial Warning Signal, Profitability, Agricultural CooperativesAbstract

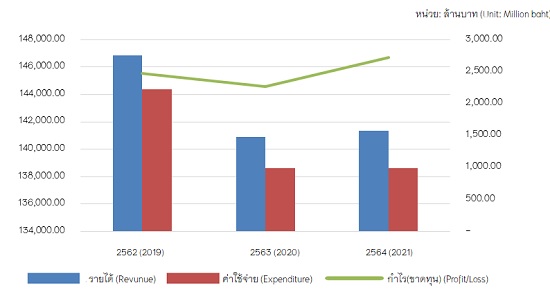

The financial warning signal of the Cooperative Auditing Department was the instrument for assessing the financial health of the agricultural cooperatives to facilitate proactive responses to potential crises. Therefore, the objectives of this research were: 1) to study the financial status and operating performance of the agricultural cooperatives in Thailand; and 2) to study the impact of financial warning signal ratios on the profitability the agricultural cooperatives in Thailand. The variables were identified as follows: The independent variables were the debt-to-equity ratios, reserve-to-asset ratios, return on assets ratios, operating expense to profit before operating expense ratio and inventory turnover ratios. Moreover, the dependent variable was the profitability. This research was quantitative research. The samples were 4,853 cooperatives focusing on the agricultural cooperative in Thailand during the period from 2019 to 2021 by a purposive sampling method. The research instrument consisted of a worksheet validated by RSU Ethics Review Board and data gathered from the Financial Information Services System for Cooperatives by the Cooperative Auditing Department, and analysed the statistics including frequency, percentage, mean, median, standard deviation, minimum, maximum, correlation analysis and multiple regression for data analysis. The research findings indicated that the financial status of agricultural cooperatives tended to remain relatively stable. However, the operating performance revealed a trend of overall income and expenses decreasing from 2019. The research findings on the influence of the financial warning signal ratios on the profitability of agricultural cooperatives found that the agricultural cooperatives with higher reserve-to-asset ratios and return on assets ratios experienced improved profitability. On the other hand, if the agricultural cooperatives had higher operating expense to profit before operating expense ratio, it resulted in decreased profitability. However, the debt-to-equity ratio and inventory turnover ratio did not affect the profitability of the agricultural cooperatives. Thus, this information can be used as a guideline for monitoring potential financial crises that may occur within the cooperative. It also encourages the implementation of financial management in various aspects of the cooperative, such as managing funds, assets, income, and expenses, to maximize profits and ensure the sustainable existence of the agricultural cooperative.

References

Best, J. W., & Kahn, J. V. (2006). Research in Education (10th ed.). Pearson Education.

Boonlert-U-Thai, K., Srijunpetch, S., & Phakdee, A. (2022). Archival Accounting Research. TPN Press.

Boonpongha, S. (2019). Factors Affecting Profitability of Listed Companies in the Information and Communication Technology Industry in the Stock Exchange of Thailand [Independent Study, Master of Accountancy Program, University of the Thai Chamber of Commerce]. UTCC Scholar. https://scholar.utcc.ac.th/entities/publication/681c36b7-c71f-4bda-910b-f93065bdf022

Chantanasir, S. (2022). Operational Efficiency Factors Affecting Profitability of the Companies of the Agricultural and Food Industry Group Listed on the Stock Exchange of Thailand: Food and Beverage Sectors. Journal of Multidisciplinary in Humanities and Social Sciences, 5(1), 232-249.

Cooperative Auditing Department. (2022a). Financial Information Services System for Cooperatives. Cooperative Auditing Department. https://inputform.cad.go.th/CAD_WS/

Cooperative Auditing Department. (2022b). The Report on Operational Performance and Financial Status of Agricultural Cooperative for the Fiscal Year 2021. Financial Analysis Unit, Information Technology and Communication Technology Center, Cooperative Auditing Department. https://www.cad.go.th/download/statistic1/in_2_64.pdf

Cooperative Auditing Department. (2022c). Financial Information for Cooperatives and Farmers Groups in 2021. Information Technology and Communication Technology Center, Cooperative Auditing Department. https://www.cad.go.th/ewt_dl_link.php?nid=47783

Dhaka, D., & Mueser, P. (2023). Agricultural cooperatives and the failure to achieve commercialization of agriculture in Nepal: A case study of the Chitwan district. Research in Globalization, 7, 1-11. https://doi.org/10.1016/j.resglo.2023.100165

Juangsang, C., & Saengkhiew, P. (2021). The Relationship Between Profitability and Earnings Quality of the Real Estate and Construction Sector Listed on the Stock Exchange of Thailand. UMT Poly Journal, 18(2), 72-81.

Songjarean, P. (2022). The Relationship Between Capital Structure and Profitability of Listed Companies in the Stock Exchange of Thailand. Rajapark Journal, 16(47), 177-188.

Vanichbuncha, K., & Vanichbuncha, T. (2015). Using SPSS for Windows to Analyze Data (27th ed.). Samlada.

Wafullah, N. T. (2019). Agricultural Cooperatives. Delve Publishing.

Wongrasameeduan, R. (2020). Managerial Accounting. Sematham.

Yodrach, W., & Yangklan, P. (2021). Relationship Between Financial Ratio and Profitability of Food and Beverage Business Group Listed in the Stock Exchange of Thailand. Sripatum Chonburi Academic Journal, 18(2), 114-126.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Research and Development Institute, Nakhon Ratchasima Rajabhat University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.