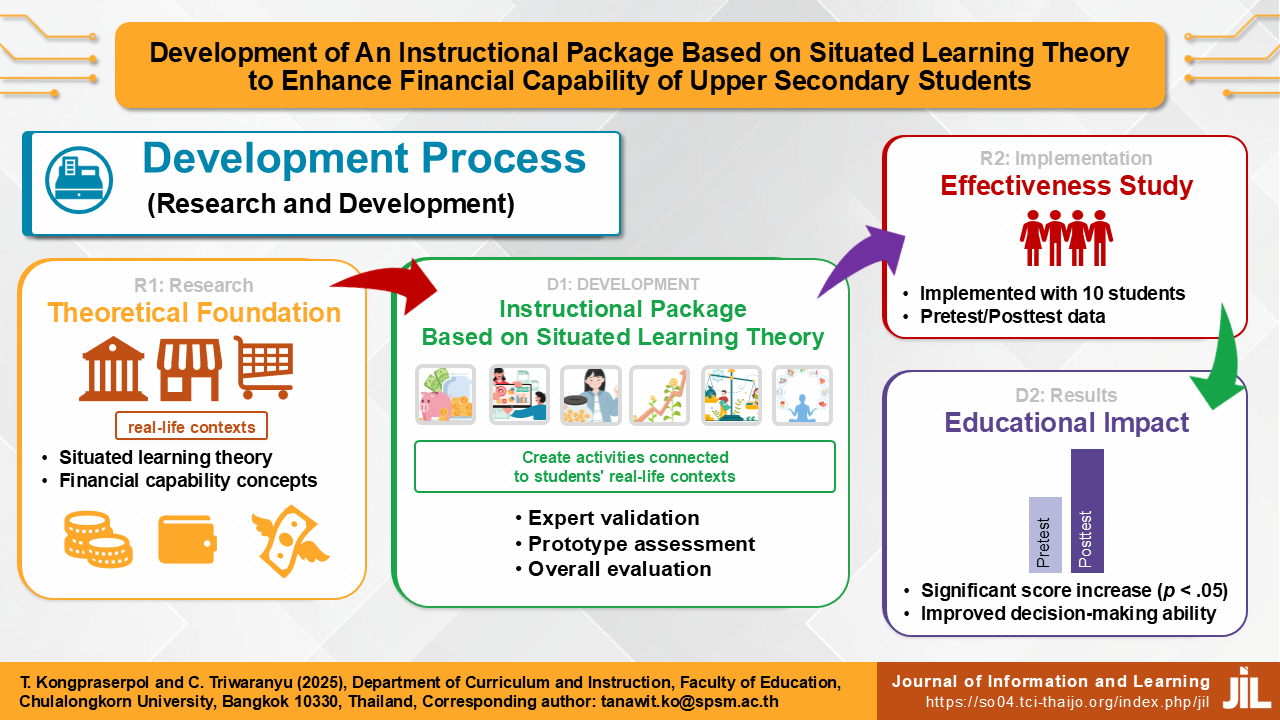

Development of An Instructional Package Based on Situated Learning Theory to Enhance Financial Capability of Upper Secondary Students

Main Article Content

Abstract

This research aimed to 1) develop an instructional package based on situated learning theory to enhance upper secondary school students’ financial capability, and 2) study the effectiveness of the developed package. The target group consisted of 10 volunteers upper secondary students from a demonstration school. The experimental instrument was the developed instructional package, and data were collected using a financial capability assessment and qualitative data records. The data were analyzed using the Wilcoxon Signed-Rank Test, relative gain scores, and content analysis. The findings were as follows: 1) The developed instructional package is a systematic integration of activities, media, instructional procedures, and user guidelines. Its components include: principles, objectives, instructions, eight sequential instructional activities progressing from familiar to more complex financial topics, media and resources, and assessment methods. In this process, the instructor designed scenarios tailored to the students' financial contexts, allowing students to set goals, confront the scenarios and reflect on their financial decisions and actions. 2) Students' post-implementation mean scores for financial capability were significantly higher than their pre-implementation scores (p < .05). Students showed significant development in their ability to make decisions and regulate their own financial actions. Furthermore, qualitative analysis indicated that designing scenarios to be related to the students' real-life contexts enabled them to demonstrate appropriate and concrete financial behaviors.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

The Journal of Information and Learning is operated by the Office of Academic Resources, Prince of Songkla University. All articles published in the journal are protected by Thailand copyright law. This copyright covers the exclusive rights to share, reproduce and distribute the article, including in electronic forms, reprints, translations, photographic reproductions, or similar. Authors own copyrights in the works they have created as well as the Office of Academic Resources. The Journal reserves the right to edit the language of papers accepted for publication for clarity and correctness, as well as to make formal changes to ensure compliance with the journal's guidelines. All authors must take public responsibility for the content of their paper.

References

Apisuksakul, K. (2021). Development of an online testing system for measure and reported financial literacy of upper secondary school students: an application of construct map approach and user experience research [Unpublished master’s thesis]. Srinakharinwirot University.

Atkinson, A., & Messy, F. (2012). Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) Pilot study”. OECD Working papers on finance, insurance and private pensions, No. 15, OECD Publishing, Paris. https://doi.org/10.1787/5k9csfs90fr4-en

Australian Government. (2022). National financial capability strategy. Moneysmart. https://files.moneysmart.gov.au/media/vyfbpg4x/national-financial-capability-strategy-2022.pdf

Bank of Thailand. (2013a). Household financial access survey reports. Bank of Thailand.

Bank of Thailand. (2013b). Thai financial literacy survey reports. Bank of Thailand.

Bank of Thailand. (2016a). Household financial access survey reports. Bank of Thailand.

Bank of Thailand. (2016b). Thai financial literacy survey reports. Bank of Thailand.

Bank of Thailand. (2018a). Household financial access survey reports. Bank of Thailand.

Bank of Thailand. (2018b). Thai financial literacy survey reports. Bank of Thailand.

Bank of Thailand. (2020a). Household financial access survey reports. Bank of Thailand.

Bank of Thailand. (2020b). Thai financial literacy survey reports. Bank of Thailand.

Bank of Thailand. (2022a). Household financial access survey reports. Bank of Thailand.

Bank of Thailand. (2022b). Thai financial literacy survey reports. Bank of Thailand.

Çera, G., Khan, K. A., Mlouk, A., & Brabenec, T. (2020). Improving financial capability: The mediating role of financial behaviour. Economic Research-Ekonomska Istraživanja, 34(1), 1265–1282. https://doi.org/10.1080/1331677X.2020.1820362

ChanChang, J. (2019). The effects of using a tablet-based learning package with gamification approach to enhance mathematics learning achievement of Grade 4 students with different learning abilities. Journal of Education Studies, Chulalongkorn University, 47(2), 18–30. https://so02.tci-thaijo.org/index.php/EDUCU/article/view/195855

Kraitzek, A., Förster, M., & Walstad, W. B. (2022). Comparison of financial education and knowledge in the United States and Germany: Curriculum and assessment. Research in Comparative and International Education, 17(2), 153–173. https://doi.org/10.1177/17454999221081333

Lave, J., & Wenger, E. (1991). Situated learning: Legitimate peripheral participation. Cambridge University Press.

Neamphoka, G. (2021). Development of physical education instructional model using active learning and creativity-based learning to enhance physical fitness through system thinking of upper primary school students [Dissertations’s thesis, Chulalongkorn University]. CUIR. https://cuir.car.chula.ac.th/handle/123456789/80381

Nuamyoo, W., & Nasongkhla, J. (2020). A development of instructional package of mechanical with design process to enhance system thinking of elementary school students. ECT Education and Communication Technology Journal, 15(18), 1–11. https://so01.tci-thaijo.org/index.php/ectstou/article/view/228394

OECD. (2015). Survey on measuring financial literacy and financial inclusion. France.

OECD. (2022). OECD/INFE toolkit for measuring financial literacy and financial inclusion 2022. www.oecd.org/financial/education/2022-INFE-Toolkit-Measuring-Finlit-Financial-Inclusion.pdf

Phromwong, C. (2013). Testing the effectiveness of instructional media or packages. Silpakorn Educational Research Journal, 5(1), 7–20. https://so05.tci-thaijo.org/index.php/suedureasearchjournal/article/view/28419

Sakondhawat, K. (2019). Development of economic learning activity package sing scenario-based learning to promote financial literacy of lower secondary school students [Unpublished master’s thesis]. Chulalongkorn University.

Serido, J., Shim, S., & Tang, C. (2013). A developmental model of financial capability: A framework for promoting a successful transition to adulthood. International Journal of Behavioral Development, 37(4), 287–297. https://doi.org/10.1177/0165025413479476

Thongphuak, P. (2018). Effects of economics instruction by using simulation games on financial literacy of upper secondary school students [Unpublished master’s thesis]. Chulalongkorn University.

Xiao, J. J., Huang, J., Goyal, K. & Kumar, S. (2022). Financial capability: A systematic conceptual review, extension and synthesis. International Journal of Bank Marketing, 40(7), 1680–1717. https://doi.org/10.1108/IJBM-05-2022-0185